The call is free and completely confidential. It provides a lender with added security when lending out.

The Truth Should You Never Pay A Debt Collection Agency Solosuit Blog

The company must maintain an interest coverage ratio of 370 based on cash flow from operations.

. In the case of a debtor who has defaulted on an auto loan the lender may decide to repossess the car thereby securing the property for the bad debt. This most commonly means credit card debt but can also refer to items like personal loans and medical debt. Unsecured debt is any debt that is not tied to an asset like a home or automobile.

7031 Koll Center Pkwy Pleasanton CA 94566. The second part of a secured debt is the creditors legal claim lien or security interest on the property that serves as collateral for the debt. These are very common examples of unsecured debts.

Terms in this set 49 tfUse of a charge card is not a secured transaction within the meaning of UCC. If youre overwhelmed with unsecured debt like credit cards its a simple solution Dickson says referring to the debt snowball strategy. The company cannot pay annual cash dividends exceeding 60 of net earnings.

In other words if you dont pay the debt the creditor cannot come and take anything away from you because theres nothing. A lender enters into a debt agreement with a company. Lets say you have three credit cards totaling.

Click Here To Begin Online Credit Counseling. You can also start a free online credit counseling session right now. In Figure 191 The Grasping Hand Attachment is the outreached hand that is prepared if the debtor defaults to grasp the collateral.

The debt agreement could specify the following debt covenants. Up to 25 cash back Once your personal liability is eliminated the creditor cannot sue you to collect the debt. What to Know Before You Sign a Loan Agreement.

If you use a savings account or CD as collateral a minimum balance may be required. Tf Goods and other inventory items cannot be used as collateral. We say that theyre unsecured because theres no collateral attached to the debt.

TfA bond which is an evidence of indebtedness may serve as collateral. The lender may restrict how you use the money you borrow. Uniform Commercial Code Section 9-203a.

Rented or leased property cant be used as collateral because the borrower doesnt have the right to give it up. If a lender should seize an asset after a bill goes unpaid they can sell. Home equity the difference between the current value and outstanding obligations can be used as collateral for a personal loan too.

The company cannot borrow debt that is senior to this debt. Credit card debt is the most widely held unsecured debt. Unsecured debt creates less stress and fewer problems for consumers because they dont stand to lose an asset if they dont repay the debt.

A creditor can file a financing statement as long as you have signed the security agreement for the collateral that it is supposed to cover. In effect those items are considered collateral for the money that is owed and can be taken back by the lender if the loan becomes delinquent. Secured debt is debt that will always be backed by collateral which the lender has a lien on.

Bankruptcy Code lists 19 different categories of debts that cannot be discharged in Chapter 7 Chapter 13 or Chapter 12 a more specialized form of bankruptcy for family farms and. Unlike security agreements financing statements dont have to signed to be effective. Items can of course be bought on hire purchase agreements but these remain the property of the seller until the debt is paid and an item can be pawned but the pawnbroker will retain it pending full repayment.

Attachment is the term used to describe when a security interest becomes enforceable against the debtor with respect to the collateral. Attachment of the Security Interest In General. Personal loans can be used for a variety of reasons such as paying for a big-ticket item or consolidating credit card debt.

Once this process is complete you will receive. In certain situations where a debtor has defaulted or is extremely delinquent the lender may decide to try and secure the bad debt by seizing the property of the debtor. Instead the bankruptcy trustee may take any property you own that isnt exempt sell it and distribute the assets to your creditors.

Some lenders may charge high interest rates or high fees for secured personal loans especially if you have bad credit. In terms of a persons assets land is unique in that a debt can be secured against it without the owner giving up control of the asset. Other unsecured debts include student loans payday loans medical bills and court-ordered child support.

When you file for Chapter 7 bankruptcy you dont have to directly repay any of your debt. Secured debt means that money owed on a bill is linked to a tangible asset - a mortgage on a house or an auto loan for a car. An unsecured debt is something like a credit card debt a medical debt a payday loan.

Up to 25 cash back A financing statement is a document that identifies the borrower lender and collateral for a secured debt.

Entrepreneur Startup Funding Finance Loans Business Funding

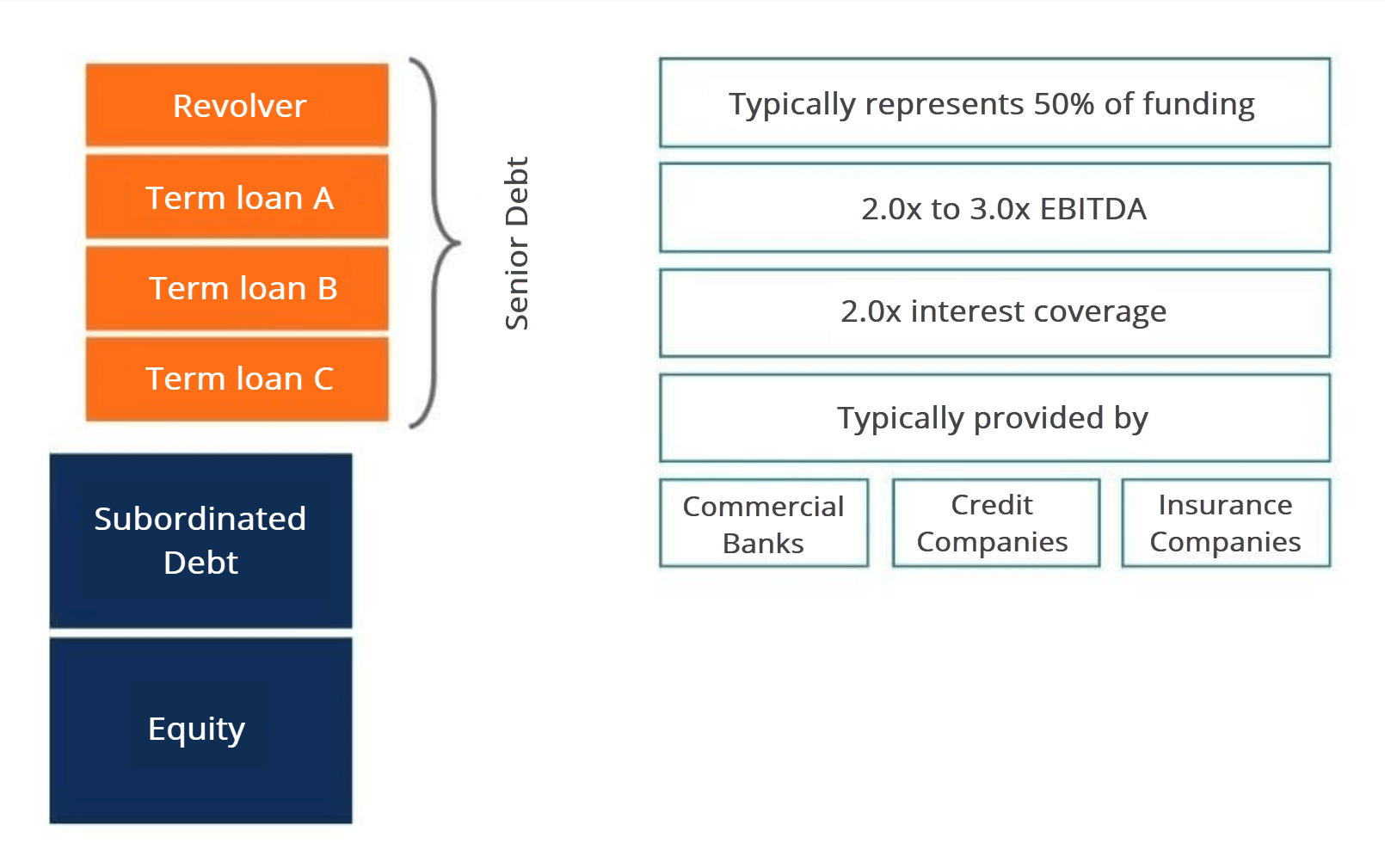

Senior And Subordinated Debt Learn More About The Capital Stack

:max_bytes(150000):strip_icc()/terms-c-cross-collateralization-0cb8f66776c346949f9b7cf236ecefbc.jpg)

Cross Collateralization Definition

How To Pay Off Credit Card Debt Paying Off Credit Cards Small Business Credit Cards Secure Credit Card

0 Comments